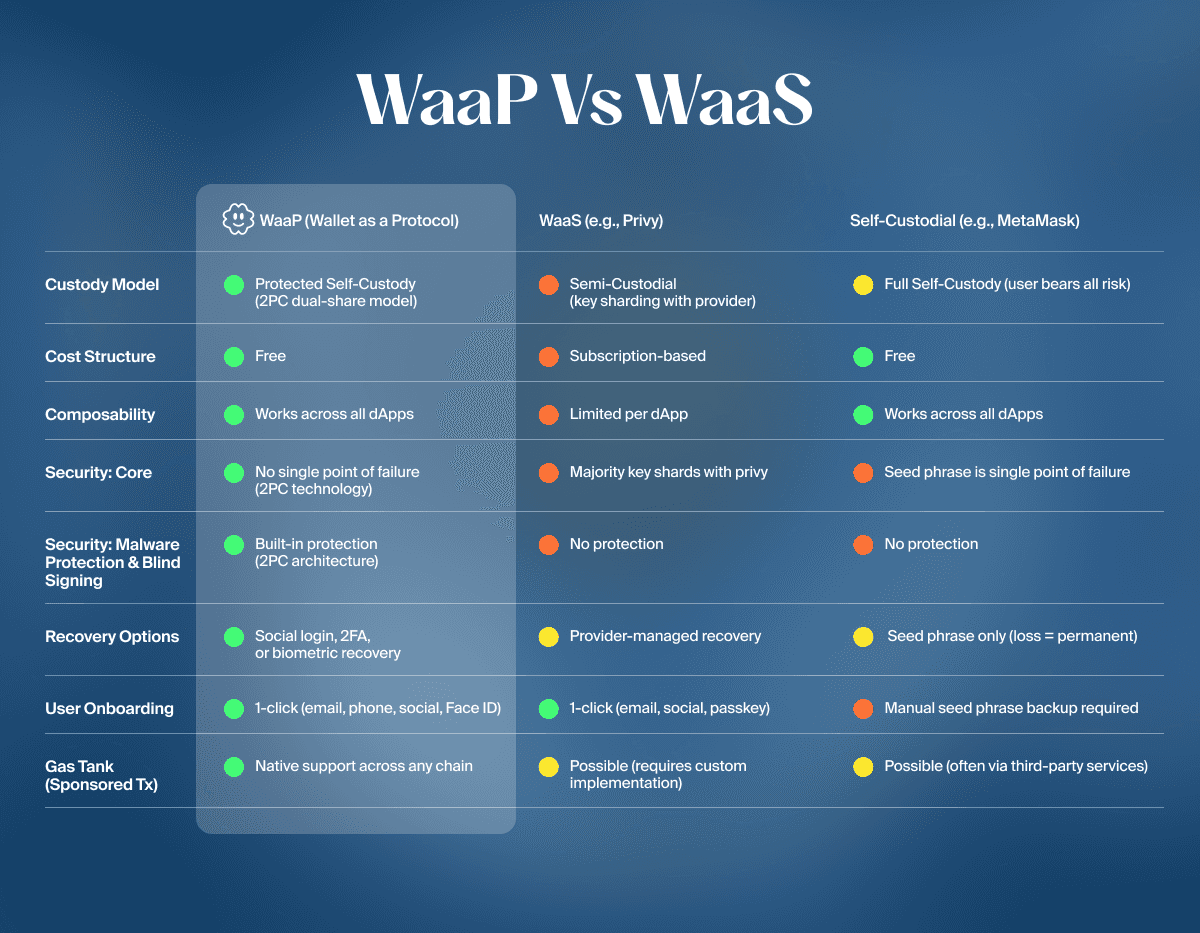

Wallets as a Service (WaaS) have improved onboarding by letting dApps embed wallets with easy logins and branded UX, replacing or complementing seedphrase wallets in many apps. But the convenience comes with three tradeoffs: (1) wallets are not owned, but rented because key management is a paid service and the provider can have unilateral control, (2) it increases the attack surface by trusting the app frontend, the browser, and the user to be diligent, and (3) it fragments the on-chain experience by forcing users into per-app wallets that do not compose across applications.

Wallet as a Protocol (WaaP), on the other hand, lets you create one universal account composable with all apps with 2-click onboarding, human friendly recovery, and protected self custody through two decentralized networks that guard but never gate.

human.tech’s, Wallet as a Protocol (WaaP) is a decentralized free wallet infrastructure for dApps to create native embedded wallets. It’s secured by two core networks and extended via plugins:

On chain key generation and management through Human Network’s Human Key Infrastructure

Programmable security at the signing layer through 2PC and Ika’s 2PC MPC protocol

Plugins for cross-chain gas tank, blind signing protection, MFA, WhatsApp-based onboarding, embedded on-chain identity with zero-knowledge AML flows, and more

It’s Time for an Upgrade

WaaS is just another name for SaaS: Centralized and per-wallet pricing

Much like SaaS, Wallet as a Service provides businesses with ready-to-use infrastructure, abstracting away the complexities of wallet management, while developers can focus on their core product. They also provide easy onboarding and Web2-like convenience.

In WaaS, the incentives shift toward quantity not quality of the userbase: applications are charged on a per-user basis, leading to extensive bills for developers onboarding a significant audience. The incentives favors ephemeral users in walled gardens rather than users using wallets for personal finance.

WaaS architecture creates separate wallets per app. As a result, one user is billed separately across many apps and suffers a “walled-garden wallet” that only works on one dApp. Whereas most productive usage of wallets requires cross-app compatibility.

If the goal is self-custody, you want protocol-level guarantees, not service-level promises.

WaaS’s Custodial Model

While the model is different for each service, as a general framework, keys are custodied not only by the centralized social logins, but also by the iframe, widening the attack surface. In most cases, while not publicized, the key is often available to the WaaS company. Further, in most common embedded wallet setupsdApps can sign any transaction on behalf of the user, effectively owning the user’s wallets.

As a result, WaaS creates different wallets for each dApp, so that logging into malicious dApp A cannot drain the wallet from dApp B. While seemingly beneficial, it also means wallets are locked into particular dApps, and you cannot use the benefits of most crypto wallets like MetaMask: being able to use the same wallet on multiple dApps.

Imagine creating a new PayPal account for any new website you pay on, and transferring funds between your 100+ PayPal accounts to the new website. You would never use PayPal. In fact, you would likely never use any traditional financial applications like Apple Pay, Google Pay, bank accounts, etc., if they worked this way, nor would you use wallets if they worked this way. Yet, this is how WaaS must work due to their custody model.

Fragmented on-chain experience sustains rent-seeking models.

While per-app wallet model contains risk, it also makes WaaS’s pay-per-wallet revenue model more lucrative. More wallets per user means more fees for the provider. The result is not so favorable for developers and users: fragmented accounts, lost composability and reputation, and a recurring cost for developers/applications, commonly about 3–8 cents per wallet per month.

WaaP is here: free, composable, protected

Wallet as a Protocol replaces rentable services with accounts that users own. The user creates one universal account that works across dApps on any chain and can be cross-authenticated across devices. Developers don’t pay any per-wallet fees. Revenue comes from user activity and the underlying Human Network economics that support the human.tech stack.

Simplicity and Universal Access

Wallets are created through Human Network’s Human Keys. Instead of deriving keys from randomness, Human Keys are derived from human attributes such as social login, biometrics, and phone numbers. The network computes vOPRF, by masking the underlying identity data while still enabling deterministic key derivation across devices.

This breakthrough turns identity into the key. Instead of managing private keys, you simply prove who you are, in ways you’re comfortable with, to access an account you own, without relying on seedphrases, centralized infrastructure, or social guardians. 2.5 Million keys have been generated till date. .

Programmable Cryptographic Security of 2PC MPC

Wallet as a Protocol enforces security policies such as access control and transaction rules through Ika’s 2PC MPC. It’s similar to a theft prevention mechanism enforced by banks, but using programmable cryptography with full user sovereignty.

In 2PC MPC, a private key is split into two independent signing shares. This removes single points of failure in the user’s device, the user themself, or any third party that interacts with the key. The “2” in “2PC” corresponds to the user and a network. The user holds one share of the key. This key can be requested from the Human Network at any time. A decentralized network, like Ika, operates the second share, verifies intent against policy, and presents a human-readable summary before it co-signs.

The “M” in “MPC” stands for many nodes in the network. The Ika network can compute MPC (multi-party-computation), like scalable two-party ECDSA signatures, across hundreds of validators, or even thousands of nodes. Ika is presently secured by 97 validators. This is a vast improvement over small scale MPC implementations and helps scale the decentralization of critical compute infrastructure.

Zero Fees, Sustained by Protocol Economics

WaaP has zero integration cost, no monthly SaaS fees or per user fees, and can be integrated in 3 minutes.

Revenue is derived from user transaction activity like transfers, swaps, minting identity proofs, which is routed to dApps driving the usage and nodes maintaining WaaP’s underlying protocol. Here, value of the protocol flows to the edges; the users, application developers and nodes maintain the integrity of the protocols, creating a self infrastructuring and sustainable incentive model.

Get Started!

Integrate in minutes. The quick start gets a wallet working in about five minutes. WaaP is EIP-1193 compliant, so your dApp may use the standard provider interface common across Ethereum wallets.

Start building with WaaP